These battles are necessary, but they will be expensive, and economic and political constraints will limit governments’ ability to finance them with higher taxes. Tax-to-GDP ratios are already high in most advanced economies, especially Europe, and tax evasion, avoidance, and arbitrage will further complicate efforts to increase taxes on high incomes and capital (assuming such measures could even get past the lobbyists or gain support from center-right parties).

Tax and spend

Higher government spending and transfers, without a commensurate increase in tax revenues, will cause structural budget deficits to grow even larger than they already are, potentially leading to unsustainable debt ratios that will increase borrowing costs and culminate in debt crises – with obvious adverse effects on economic growth. Of course, under these conditions, many emerging-market and developing countries with foreign currency-denominated debt will need to default or undergo coercive restructurings. But for countries that borrow in their own currencies, the expedient option will be to allow higher inflation as a means of eroding the real value of long-term fixed-rate nominal debt.

This approach, which functions as a tax on savers and creditors and a subsidy for borrowers and debtors, can then be combined with other draconian measures such as financial repression or taxes on capital. Since many of these measures do not require explicit legislative or executive approval, they inevitably become the path of least resistance when deficits and debts are unsustainable.

Already, bond markets have started to signal concerns about unsustainable fiscal deficits and public debts.

Already, bond markets have started to signal concerns about unsustainable fiscal deficits and public debts, not just in poor countries and emerging markets but also in advanced economies. A sharp rise in long-term bond rates in both Europe and the U.S. indicates that demand for bonds is shrinking as supply rises with growing budget deficits, central banks move from QE to QT (quantitative tightening), investors seek higher risk premiums, and U.S. rivals gradually reduce their dollar reserves.

Moreover, there will likely be even more upward pressure on long-term rates in the U.S. and other G10 countries when Japan starts to normalize monetary policy and abandons the yield-curve-control policy that it has used to keep long-term rates close to 0%.

It is not just nominal bond yields that are rising; so are real yields. During the decade of secular stagnation, real long-term yields were close to zero or negative, owing to high savings and low investment rates. But we are entering an era of negative public savings (growing fiscal deficits), lower private savings (driven by aging and lower income growth), and higher investment rates (owing to climate change mitigation and adaptation, infrastructure spending, and AI).

Thus, real rates are positive, and they are being pushed higher by higher risk-premia on public bonds as debts surge. Some investment banks now estimate that the equilibrium long-term rate is close to 2.5%, while recent academic research puts it closer to 2%. In any case, the nominal and real cost of capital will be much higher in the future.

The new de facto (though not official) inflation target over the next decade may hew closer toward 4-5%.

Given the aggregate supply and demand factors driving inflation higher, the new de facto (though not official) inflation target over the next decade may hew closer toward 4-5%. But accepting a higher inflation rate may de-anchor inflation expectations – as happened in the 1970s – with serious consequences for economic growth and returns on financial assets.

Life after the ‘everything bubble’

Until 2021, monetary, fiscal, and credit easing inflated the valuations of just about everything: U.S. and global equities, real estate, and government and corporate bonds; tech, growth, and venture firms, and speculative assets including cryptocurrencies, meme stocks, and SPACs (special purpose acquisition companies). When this “everything bubble” burst in 2022, speculative assets – starting with VC, crypto, and meme stocks – lost much more value than traditional stocks.

But safe assets such as government bonds also lost money as higher long-term interest rates brought bond prices down. For example, the rise in bond yields in the U.S. from 1% to 3.5% in 2022 implied that 10-year Treasury bonds BX:TMUBMUSD10Y lost more in price (-20%) than the S&P 500 SPX (-18%). This year brought additional losses on long-duration bonds (around -15% in price terms) as bond yields surged further toward 5%. Traditional asset-allocation models that balance equities against bonds thus lost on both fronts.

If bond yields rise from their current 4.5% to 7.5%, that will cause a crash in both bond prices (by 30%) and equities.

This bloodbath is likely to continue. With average inflation running 5%, rather than 2%, long-term bond yields would need to be closer to 7.5% (5% for inflation and 2.5% for a real return). But if bond yields rise from their current 4.5% to 7.5%, that will cause a crash in both bond prices (by 30%) and equities (with a serious bear market), because the discount factor for dividends will be much higher. Globally, losses for bondholders and equity investors alike could grow into the tens of trillions of dollars over the next decade.

To be sure, U.S. and global equities did rally through the middle of 2023, following the 2022 bear market. But most of this was driven by a small group of Big Tech stocks that benefited from the hope and hype around generative AI. If one excludes these high-flyers, markets were almost flat.

Moreover, for most of 2023, investors were engaged in wishful thinking about central banks declaring an end to the rate-hiking cycle, with many even betting on rate cuts in the near-future. But persistent inflation dashed these hopes, leading central banks to adopt a policy of “higher for longer,” which is likely to lead to an economic contraction and additional financial stress. This past summer and fall, U.S. bond yields surged from 3.7% toward 5%, alongside another significant correction of U.S. and global equities.

As far as growth is concerned, both the Eurozone and the United Kingdom are already in a stagflationary near-recession, and China is mired in a structural slowdown. While the U.S. has avoided a recession, it may yet end up in a short and shallow one if the Federal Reserve’s “higher for longer” policy causes elevated bond yields to persist.

All recent evidence suggests that the ‘geopolitical depression’ is getting worse:

In any case, the risk of a bear market in equities is more secular than cyclical. If any number of megathreats materialize over the next decade, their stagflationary impact will undercut equities over the medium term.

All recent evidence suggests that the “geopolitical depression” is getting worse: Russia’s invasion of Ukraine has evolved into a war of attrition, with the Ukrainians mounting a grueling counter-offensive to reclaim territory lost in 2022. The war could easily intensify, pull in other parties, such as NATO, or escalate with the use of unconventional weapons. Such scenarios, of course, would bring further spikes in energy and commodity prices.

In the Middle East, Iran is poised to make the final step from uranium enrichment to building a nuclear weapon. This confronts Israel with a fateful choice: either accept a nuclear-armed Iran and hope that traditional deterrence works, or launch a military strike, which would cause a sharp spike in oil prices (among other things), potentially tipping the global economy into a stagflationary downturn. The conflict between Israel and Hamas over Gaza could well escalate into a regional one involving Iran and its Lebanese proxy Hezbollah.

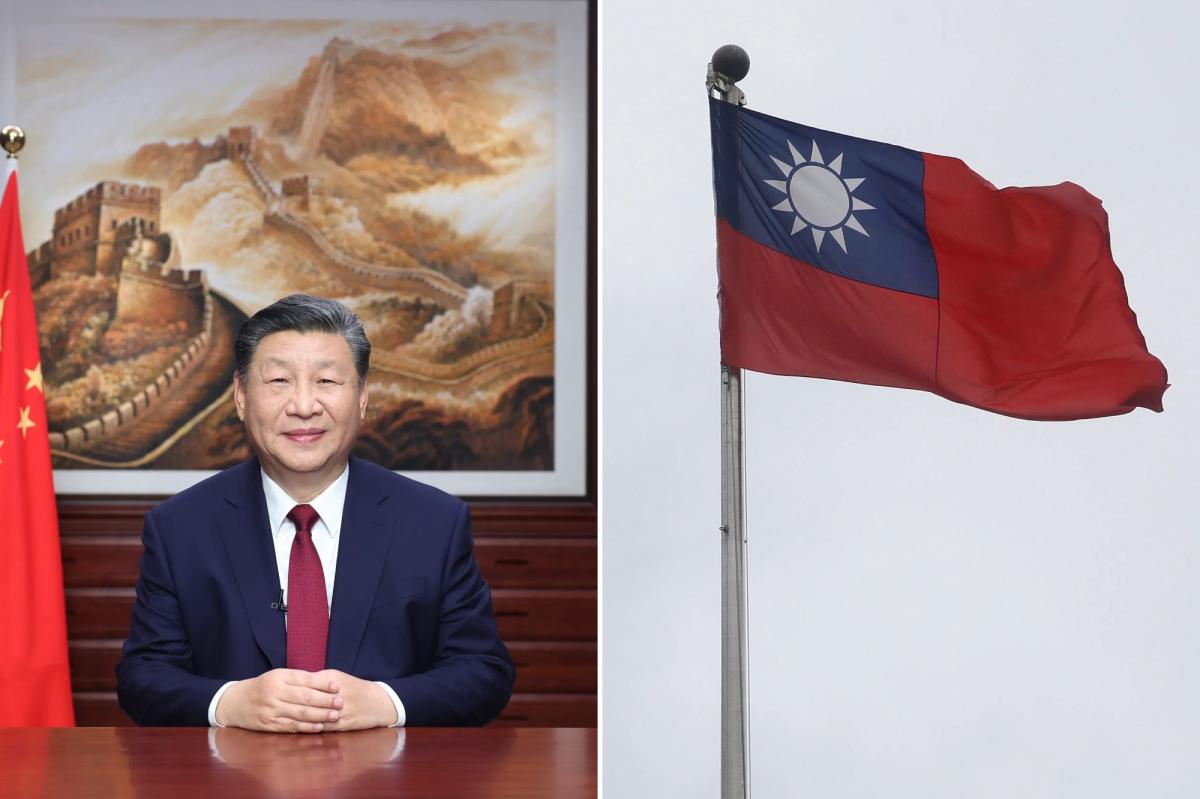

In Asia, the cold war between the U.S. and China is getting colder and could potentially turn hot if China decides to reunite Taiwan with the mainland by force. And while the world’s attention is focused on Ukraine, Taiwan and Gaza, North Korea is becoming more aggressive with its missile launches over the waters around South Korea and Japan.

Of these risks, the biggest is an escalation of the Sino-American cold war. Following the May 2023 G7 summit in Hiroshima, Japan, U.S. President Joe Biden claimed that he expected a “thaw” with China. Yet, despite some official bilateral meetings, relations remain icy. In fact, the G7 summit itself confirmed Chinese fears about the U.S. pursuing a strategy of “comprehensive containment, encirclement, and suppression.”

Unlike previous gatherings, when G7 leaders offered mostly talk and little action, the Hiroshima summit may well have been the most important in the group’s history. The recent summit in San Francisco between Chinese President Xi Jinping and Biden did not change anything structural in the collision between U.S. and China. Despite a short-term partial d?tente, the cold war is becoming colder, and may eventually become hot over the issue of Taiwan.

The Sino-Russian friendship “without limits” is having serious consequences for how other powers perceive China.

After all, the U.S., Japan, Europe, and their friends and allies made it clearer than ever that they intend to join forces to counter China. Japan, as the host, was sure to invite key Global South leaders whom it wants to enlist in containing China’s rise. Chief among these was Indian Prime Minister Narendra Modi. While India (which held the G20 presidency in 2023) has taken a neutral position on Russia’s war in Ukraine, it has long been locked in a strategic rivalry with China, owing partly to the two countries’ long shared border, sections of which remain disputed.

(MORE TO FOLLOW) Dow Jones Newswires

12-02-23 1445ET

Copyright (c) 2023 Dow Jones & Company, Inc.